Trading on platforms has become an increasingly popular way for people to invest and trade in financial markets. With the rise of technology, online trading platforms have made it easier than ever before to access global markets and execute trades quickly and efficiently. In this article, we will explore the benefits and drawbacks of trading on platforms, and provide some tips for those who are new to this exciting world.

Benefits of Trading on Platforms:

Access to Global Markets: Trading on platforms allows traders to access global markets from anywhere in the world. With just a few clicks, traders can buy and sell securities in different countries, giving them access to a wide range of investment opportunities.

Lower Costs: Online trading platforms often have lower fees than traditional brokers, making it more affordable for traders to invest in the markets. Some platforms also offer commission-free trades, which can help reduce the cost of trading even further.

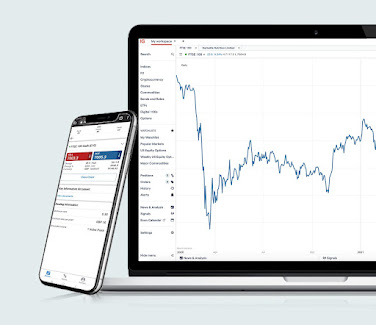

Real-time Data and Analysis: Trading platforms provide traders with real-time data and analysis, allowing them to make informed decisions about their trades. With access to real-time market data, traders can quickly adjust their strategies based on market movements and news events.

Automation: Many trading platforms offer automation tools, such as algorithms and bots, which can help traders automate their trading strategies. This can be especially useful for those who do not have the time or expertise to monitor the markets 24/7.

Drawbacks of Trading on Platforms:

Risk: Trading on platforms carries risks, just like any other form of investment. Traders can lose money if they make the wrong trades or if the markets move against them. It is important for traders to understand the risks involved and to have a solid trading plan in place.

Security: Trading on platforms requires traders to provide personal and financial information, which can make them vulnerable to fraud and cyber-attacks. It is important to choose a reputable trading platform with robust security measures in place.

Complexity: Trading platforms can be complex, especially for beginners. Traders need to understand how the platform works and how to use the different tools and features. It is important to take the time to learn about the platform before making any trades.

Tips for Trading on Platforms:

Choose a Reputable Platform: It is important to choose a reputable trading platform with a track record of security and reliability. Look for platforms that are regulated by financial authorities and have positive reviews from other traders.

Start Small: When starting out, it is important to start small and only invest what you can afford to lose. This will allow you to gain experience and confidence without risking too much capital.

Develop a Trading Plan: A trading plan is essential for success in the markets. It should include your goals, risk tolerance, and strategies for entering and exiting trades. Stick to your plan and avoid making impulsive trades based on emotions.

Learn from Mistakes: Trading is a learning process, and it is inevitable that you will make mistakes along the way. Use these mistakes as opportunities to learn and improve your trading skills.

In conclusion, trading on platforms can be a great way to access global markets and invest in the markets. However, it is important to understand the risks involved and to take the time to learn about the platform and develop a solid trading plan. By following these tips and being disciplined in your approach, you can increase your chances of success in the exciting world of trading.

Reviewed by FlixNet

on

March 23, 2023

Rating:

Reviewed by FlixNet

on

March 23, 2023

Rating:

No comments:

Écrivez votre commentaire si vous connaissez le sujet et merci.